![Midwest Real Estate Data LLC Logo]() The data relating to real estate for sale on this website comes in part from the Broker Reciprocity program of Midwest Real Estate Data LLC. Real Estate listings held by brokerage firms other than ONE SOURCE REALTY are marked with the Broker Reciprocity logo or the Broker Reciprocity thumbnail logo (a little black house) and detailed information about them includes the names of the listing brokers. Some properties which appear for sale on this website may subsequently have sold and may no longer be available. The information being provided is for consumers' personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information deemed reliable but not guaranteed. Many homes contain recording devices, and buyers should be aware they may be recorded during a showing.

The data relating to real estate for sale on this website comes in part from the Broker Reciprocity program of Midwest Real Estate Data LLC. Real Estate listings held by brokerage firms other than ONE SOURCE REALTY are marked with the Broker Reciprocity logo or the Broker Reciprocity thumbnail logo (a little black house) and detailed information about them includes the names of the listing brokers. Some properties which appear for sale on this website may subsequently have sold and may no longer be available. The information being provided is for consumers' personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information deemed reliable but not guaranteed. Many homes contain recording devices, and buyers should be aware they may be recorded during a showing.

Listings courtesy of NEIRBR Northeast Iowa Regional Board of Realtors as distributed by MLS GRID

IDX information is provided exclusively for consumers’ personal noncommercial use, that it may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing, that the data is deemed reliable but is not guaranteed by MLS GRID, and that the use of the MLS GRID Data may be subject to an end user license agreement prescribed by the Member Participant’s applicable MLS if any and as amended from time to time.

Based on information submitted to the MLS GRID as of October 16th, 2025 at 6:39am. All data is obtained from various sources and may not have been verified by broker or MLS GRID. Supplied Open House Information is subject to change without notice. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information.

The DMCA requires that your notice of alleged copyright infringement include the following information: (1) description of the copyrighted work that is the subject of claimed infringement; (2) description of the alleged infringing content and information sufficient to permit us to locate the content; (3) contact information for you, including your address, telephone number and email address; (4) a statement by you that you have a good faith belief that the content in the manner complained of is not authorized by the copyright owner, or its agent, or by the operation of any law; (5) a statement by you, signed under penalty of perjury, that the information in the notification is accurate and that you have the authority to enforce the copyrights that are claimed to be infringed; and (6) a physical or electronic signature of the copyright owner or a person authorized to act on the copyright owner’s behalf. Failure to include all of the above information may result in the delay of the processing of your complaint.

The Digital Millennium Copyright Act of 1998, 17 U.S.C. § 512 (the “DMCA”) provides recourse for copyright owners who believe that material appearing on the Internet infringes their rights under 6 MLS GRID IDX Rules Updated September 16, 2024 U.S. copyright law. If you believe in good faith that any content or material made available in connection with our website or services infringes your copyright, you (or your agent) may send us a notice requesting that the content or material be removed, or access to it blocked. Notices must be sent in writing by email to: ONE SOURCE REALTY

Listing information last updated on October 16th, 2025 at 6:39am CDT.

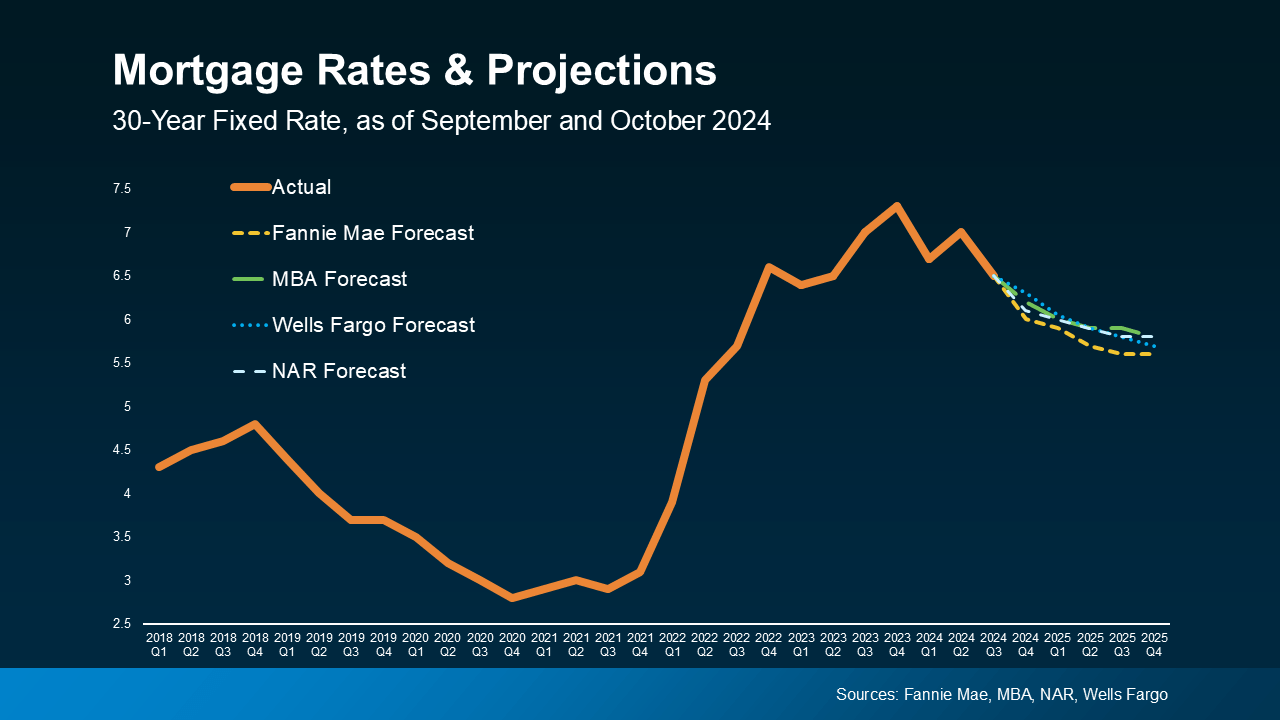

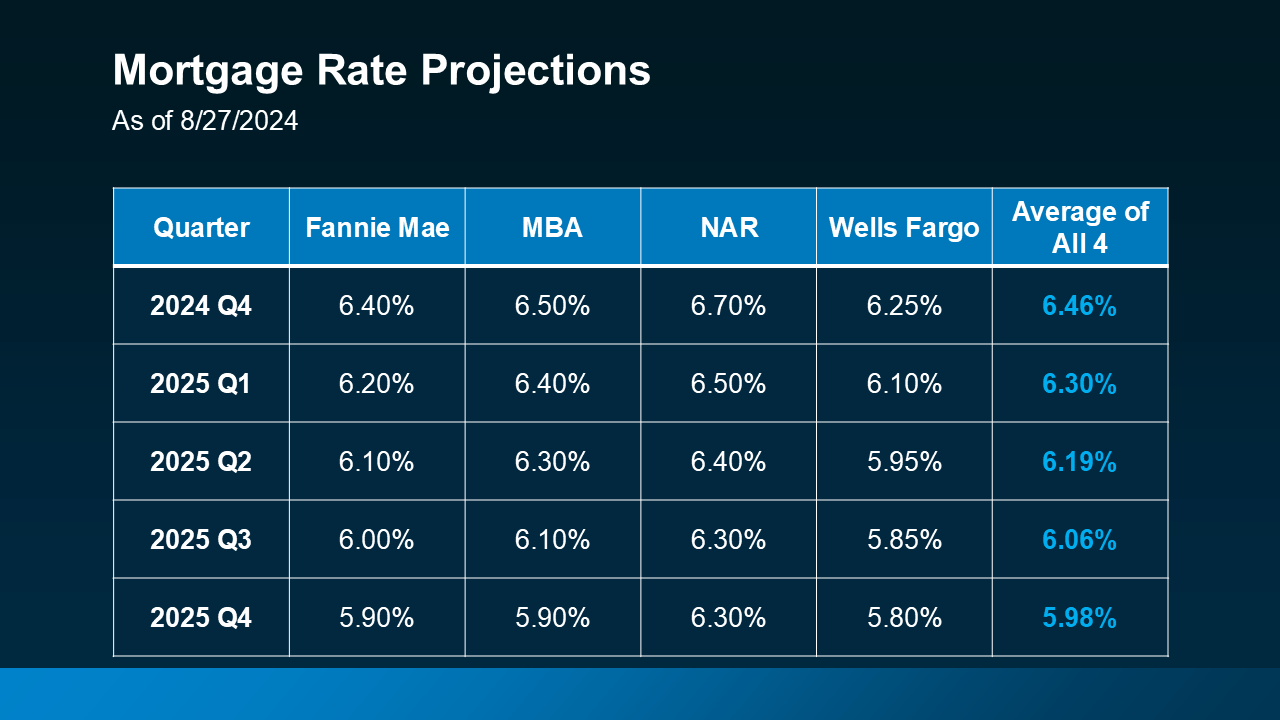

While that decline won’t be a straight line down, the overall trend should continue over the next year.…

While that decline won’t be a straight line down, the overall trend should continue over the next year.…

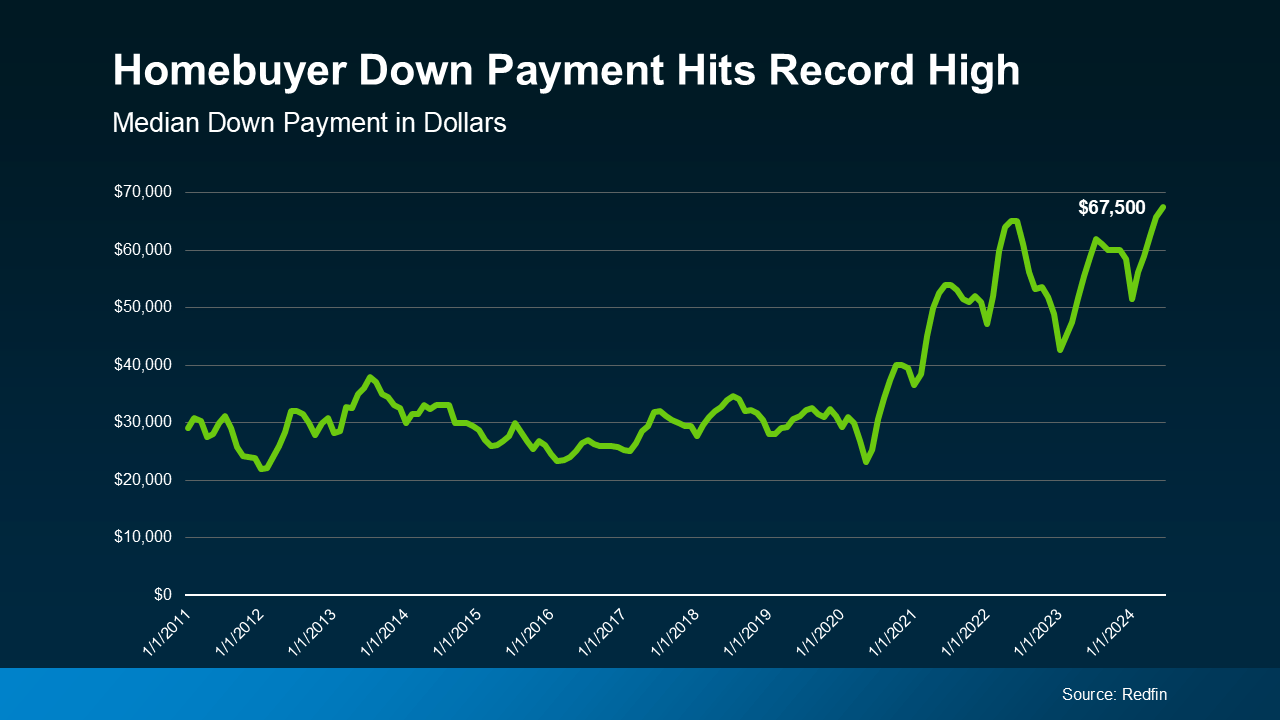

Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a…

Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a…

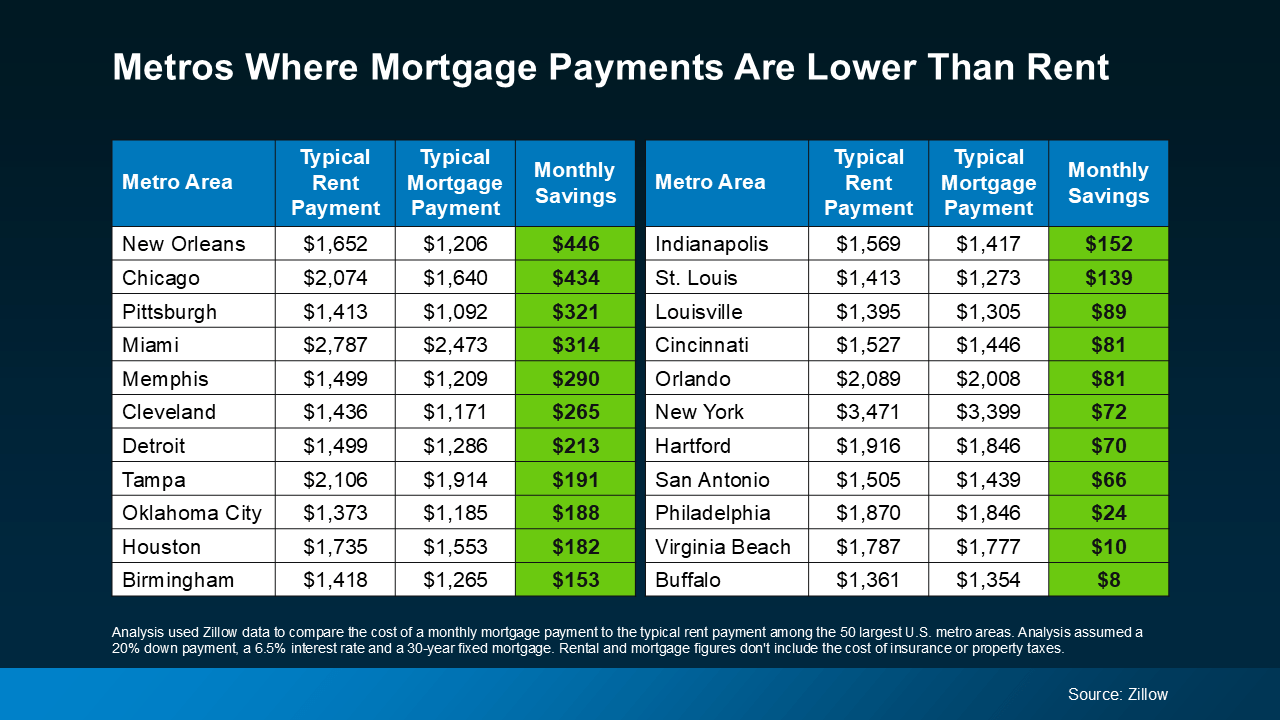

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

While…

While… …

…